1. What is Leveraged Finance?

Leveraged Finance is essentially the use of high levels of debt for financing strategic corporate actions. These actions could be things like acquisitions, share repurchases, recapitalisations, capex and so on. Leveraged financing differs from normal financing in the sense that the amount of debt is dis-proportionality large as a fraction of the total funding which includes things like equity and reserves.

The Leveraged Finance teams at banks act as intermediaries and help companies raise funding using the aforementioned strategies. They do the advisory, the structuring and the eventual execution of such deals.

2. Job Description

LevFin teams help their clients raise financing for highly leveraged, strategic business purposes.

- The “highly leveraged” part should be pretty obvious as this simply means that the amount of debt is a lot higher than what is considered normal for that industry. This means more credit risk, higher performance risk, and therefore a lower credit rating and higher yields.

- The “strategic” part means that the financing is usually for an acquisition, a leveraged buyout, strategic capex or something of that nature. It is usually not suitable for funding your day to day activities and other opex (operational expenses) requirements.

What LevFin teams do might seem to be very similar to what DCM (Debt Capital Markets) or even direct lending corporate banking teams do; and in a sense this is true. However, the difference is more in terms of who they do it for and why rather than what they do. Leveraged financing implies a high leverage, more credit risk, more default risk and there are a different set of clients who like such deals – Private Equity firms.

PE firms will form a significant chunk of your client base in LevFin although there are a lot of corporates who do this as well. In either case, there is usually a lot of time pressure and the asset quality is far from pristine to say the least. This calls for a whole different mentality when approaching these deals when compared with vanilla lending.

2.1. How does LevFin compare to vanilla lending?

Leveraged Finance can undoubtedly be more exciting than vanilla corporate lending and vanilla issuance of investment grade bonds. LevFin deals are more sensitive, carry more risk, but most importantly – have a potential for much higher returns. This makes LevFin ideal for the analytical excitement junkie!

You also generally tend to work on more deals, which are more transactional than what you would do in other divisions. These are one-off transactions and there is no deal flow or annual reissuance or anything of that sort.

3. Qualifications & Skills

Analytical Skills – In your initial years, you would not be doing any significant client engagement at all. Most of your time would be spent poring over excel sheets, legal and contractual documents and presentations. Having an analytical mindset is critical for most banking roles and LevFin is certainly no exception. This is the datum that you have to clear before you even get to your first interview.

Credit Skills – Having excellent credit skills is crucial for a Leverage Finance role since you are dealing with loans that are riskier than what the DCM or corporate banking guys sell. This means that the credit analysis is a lot more detailed, with a lot more parameters being looked at, more scenario testing and more credit covenants. This is probably the most crucial skill that someone looking for a LevFin role would have to master. There is no comfort of a AA credit rating here but you still have to make it work.

Presentation Skills – Having performed all the analyses, it now needs to make its way to all the parties involved – the financial sponsor, the company raising the loan and your own internal teams as well. How you present information in general can really make your life a lot harder or easier. This does not mean that you have to hide any information whatsoever, it’s just that you can minimize the back and forth and won’t have to keep making tweaks if you can present the info correctly the first time around.

Creative Reasoning – Debt Capital Markets and direct lending by the corporate banking team is a bit simpler when compared with Leveraged Finance. This is because they usually have better rated clients so that itself provides a degree of comfort that is absent in LevFin deals. This means you have to come up with more creative solutions compared to what the vanilla DCM and direct lending guys are used to.

A Deal Based Mentality – LevFin is a deal-based business unit. You don’t have any regular flow business that you can rely on unlike corporate banking. This means that you sometimes have nothing to do and sometimes you can suddenly have three deals that you need to get done ASAP.

This is an important aspect of such roles that newcomers should ponder over before deciding to zero in on a career. It might seem trivial but deal based roles can take a toll on you because the work volume is often highly inconsistent.

Multi-tasking – LevFin teams usually work on more than one deal at a time. This means that you have to swivel your brain into a different mode when you start working on the second set of documents. Not everyone is suited for this as your mind can play tricks on you and you can make mistakes.

My intention is not to scare anyone off, its just that if you have a “researcher” personality (you like to go really deep into just one specific problem), then this might not be the right role for you. This role requires you to be really transactional with your work flow. In and out with zero mistakes. No need to reinvent the wheel.

Having a Flexible Schedule – If you have read the previous paragraphs, this might not come as a surprise to you. You have little control over when you can work on a deal. Often, this can mean that you have to drop everything you are doing (including your weekend plans) and just get the work done by the deadline that the client sets for you. Leveraged Finance teams often work with Private Equity firms and those guys usually have very strict deadlines and little tolerance for errors.

Consistent Performance – Your performance needs to be consistent in LevFin – more so than in some other divisions. For example, if you slack off in a business development role for a month or two, you can just work harder the next month and make up for the revenue shortfall and vice versa (in case you are thinking “yea right”, I still do this all the time!). But in LevFin you work when the client wants you to work so you can’t be the least bit inconsistent.

Legal Knowledge – Tailored contracts and legal commitments are a bigger focus in Leveraged Finance compared to some other banking divisions (M&A being a notable exception). You don’t need to pass the bar obviously but having some understanding of business law can indeed help you speed up your deliverables.

4. How to get into LevFin?

For LevFin, you need to display credit and analytical skills, numeracy, consistent performance, a deal mentality, and multi-tasking abilities, among other things. Any previous experience that can help you demonstrate these skills should be on your resume. If your CV is light on these things, you know what to focus on.

If you are joining at an analyst level, you would likely be expected to do a lot of grunt work. This is just how most of banking is in the first few years and there is no getting around that. You would do well, therefore, to demonstrate initiative and hard work instead of leadership. Not saying that leadership would harm you in any way, but it just won’t help your cause as much as having the ability to churn out excel sheets will.

There are essentially three ways to get into LevFin in your early years and you have to tailor your resume accordingly:

- The first route is the traditional get into a target school, get good grades, good internship, network and get an offer. Boom! The advantage of this route is that you have quite a bit of flexibility when moving to other related roles within investment banking.

- The second route involves lateral movement. By displaying substantial skills in other credit related roles like DCM or as a credit analyst in corporate banking, you can get a shot at LevFin. In DCM and corporate banking though you would generally be handling Fortune 100 or Fortune 500 clients, so the credit analysis part is a bit easier than what you would have to do in LevFin. This is why you have to display exceptional abilities to get in, but it is certainly doable.

- The last method is to get in straight after your MBA after having previous experience or an internship in some finance related role. This method is obviously not guaranteed to get you in, and your chances would depend on the strength of your CV including the relevance of your previous experience to LevFin.

4.1. CV Building and Technical Prep

For technical prep, there are a number of excellent courses and certifications out there. Many of the more reputable certification offered by top tier institutes will also help build your personal brand and profile for these roles. I have listed the top such courses and certifications here:

If you need professional help writing/ editing your CV, here are the best professional services to help you out. These have been handpicked to be the ones best suited for top tier investment banking roles.

Best Resume Writing & Review Services for Investment Banking & Finance ranked by Bankers

4.2. Academic Qualifications and Certifications

What works for banking in general, works for Leveraged Finance as well. For analyst level roles, you need a Business, Finance, Economics or some other mathematical degree from reputable schools and a decent GPA. For Associate level roles, you need an MBA from a reputable school.

Having an internship always helps but it doesn’t really have to be in LevFin specifically, and any analysis-heavy finance role should do. Interning with a more reputable bank will always help your cause no matter what division you want to get into.

In terms of certifications, the CFA continues to be the gold standard in banking although I would recommend the Financial Risk Management certification for credit-focused roles like Leveraged Finance.

Series 7, 63, 79 exams (or others) may be required in the United States. Please check the FINRA website for details.

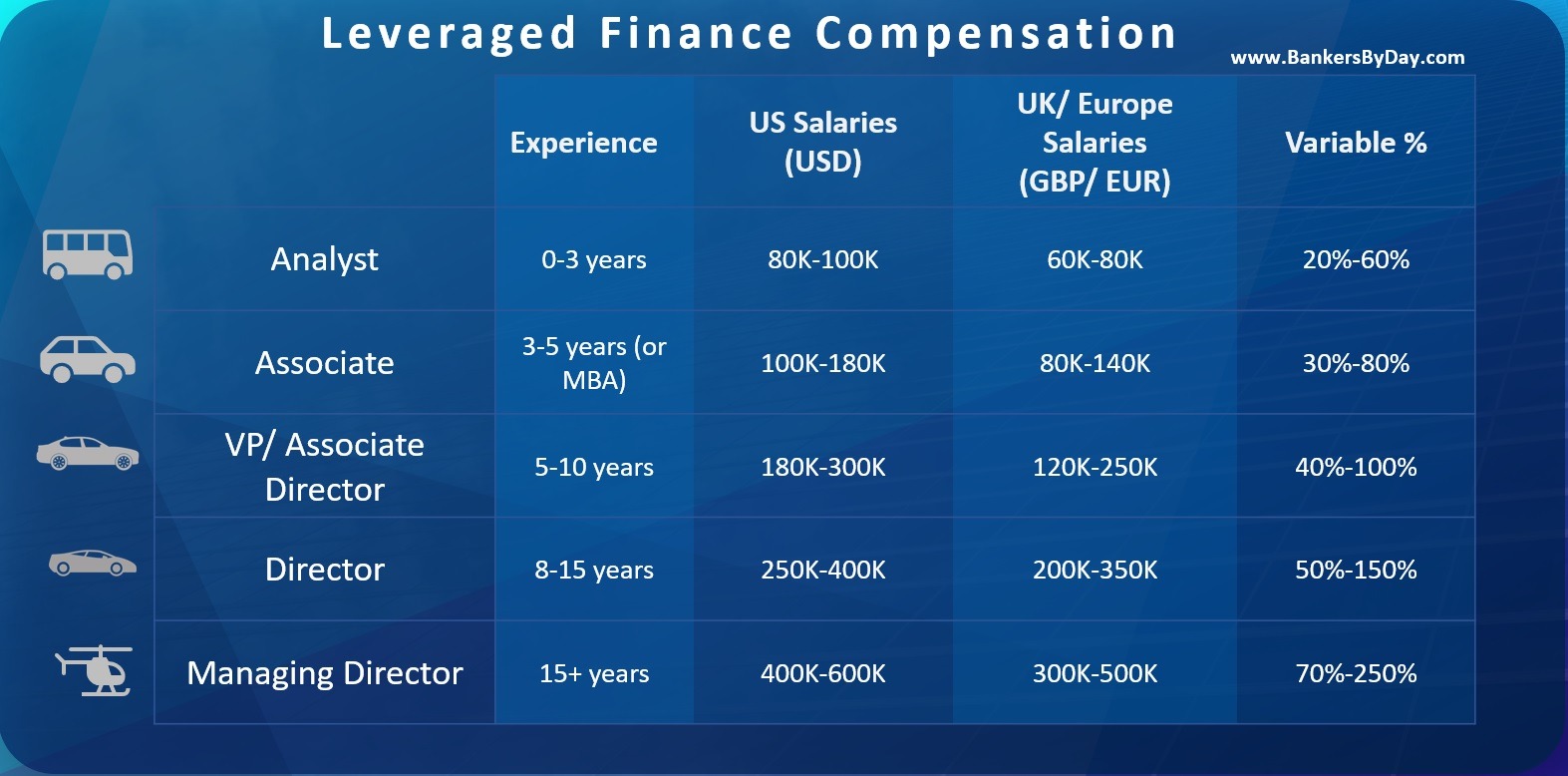

5. Salary and Bonuses

Salaries in LevFin tend to be pretty close to what people in DCM, ECM, M&A etc. make. So you should expect about USD 80K – USD 100K as an analyst with a variable component of around 20% to 60%. As an Associate, expect a fixed component of around USD 150K with the variable component being more closely tied to your performance and crossing even 80% for the high performers.

In the UK, analyst salaries are usually between GBP 60K to 80K with a 20%-60% variable component tacked on top of that. Associates can expect to make GBP 80K to GBP 140K with the variable component being based on performance and going up to 80%.

Compensation for positions higher than Analysts and Associate are based on how much revenue you bring in. The fixed component doesn’t really scale that abnormally, but the variable component can really snowball. Directors and Managing Directors usually get several million-dollar packages both in Europe and the US.

One thing to keep in mind is that at the more senior level positions you usually get stock options instead of cash bonuses which cannot be vested for several years.

6. A Normal Day in LevFin

On a daily basis, expect to spend most of your time rotating between all the deals that are currently in play. All your actives can be grouped into the following three buckets:

Analysis – The financial and credit analysis of transactions is where you’ll spend most of your time in the early years. Looking at balance sheets, cash flows, P&Ls, projections, market analysis, stress tests, simulations, and things of that nature. Rather than focusing on the company overall, your focus would be on the particular transaction though and the instruments that you are using to finance that transactions.

Communication and Negotiation – Not really something that new analysts will engage in but at the end of the day, getting a credit proposal through is all about negotiation. You might have to tweak certain conditions, or create certain safeguards, incorporate some credit covenants, bring in some third-party monitors and whatever else you need to do mitigate the inherently risky nature of the transactions.

As for communication, you would need to know how to get all the data that you need in the shortest amount of time. You also need to present your findings to others so expect to spend some time daily on presentations or memorandums.

Documentation – A good chunk of your time will likely be spent on the deal documentation. Preparing the schedules, working on contracts, coordinating with in-house or external legal teams, making amendments to contracts, seeking approvals for the amendments, and things of that nature. How much time you spend on this differs from bank to bank but sometimes, looking at anything other an excel sheet (even if it is a legal contract) can seem surprisingly refreshing!

6.1. Work Hours

The hours are on the higher side – more so than DCM/ ECM and client coverage but just slightly better than what you can expect in M&A. Expect 80+ hours on a weekly basis as an analyst. This definitely gets better with time though and starts to ease off as soon as you hit associate.

7. Career Path and Progression

LevFin has quite an interesting variety of possible career paths and exit options.

Option 1: Stay in LevFin

Leveraged Finance in itself is a great business vertical to be in. There is enough room to grow and major banks across Europe, Asia and North America all have dedicated LevFin teams. The compensation at the higher levels can easily reach in the millions of dollars depending on how much revenue you can generate for the bank. Why leave a good gig? (unless you just want to, in which case you should read on).

Option 2: Credit Roles

There is a fair bit of skill overlap with credit roles. For example, credit rating agencies, credit analysts in corporate banking etc. all share the core skillset with Leveraged Finance. The main difference is that the structuring can be a bit more complex and the stress levels higher in LevFin due to the type of clients you cover and the transactional nature of the business. Nonetheless, the point is that you do have the flexibility of moving to other credit focused roles if you need or choose to for whatever reasons.

Option 3: M&A, DCM, PF etc.

Moving to other role like M&A, Debt Capital Markets, Project Finance, Structured Finance, Distressed Assets etc. is also possible in some cases. It is almost always easier to move at the Analyst or Associate level before you really begin to get type-casted into a specific role.

Movement is also possible at the more senior levels but at that point in your career it is more a matter of having the right opportunities available to you and displaying your leadership and relationship skills.

Option 4: Private Equity

The last and perhaps most sought-after option is to get into Private Equity. LevFin works very closely with PE firms who are often times the financial sponsors of a leveraged financing facility. Over time, analysts and associates can build a good reputation with their PE client based and if you can catch an MD’s eye, you have a solid shot at making a shift.

It’s not really a guaranteed thing as this does depend on luck a bit as well – you need to have enough PE deal flow and there should be openings in those PE firms and your boss should let you have some face-time with the client and so on. But your odds would be better than most.