Introduction to ESG

Renewed emphasis on adopting ESG (Environmental, Social, and Governance) policies and practices is critical toward achieving sustainable, climate resilient socio-economic growth and development. ESG is a trend that is apparent across sectors and geographies.

WEF’s The Future of Jobs Report highlights that the fastest-growing roles are driven by technology, digitalization, and sustainability whereas LinkedIn’s “Jobs on the Rise” list for 2024 underscores the rapid growth in sustainability and energy-related roles in both Europe and the United States, with job postings seeing a 116% surge between 2019 and 2024. Compensations too, appear to be following an upward trajectory, with entry-level positions such as Sustainability Analysts starting around $60,000 annually in the US and reaching upwards of $180,000 for senior management roles such as Chief Sustainability Officers.

As organizations seek to align their operations with sustainable practices and demonstrate their commitment to ESG principles, the increase in demand for trained ESG professionals has fuelled a proportionate interest in ESG courses. A growth of nearly 30% year-over-year has been reported in some countries, indicating that this demand is consistent across geographies.

Professionals looking to transition to the ESG space can use the following indicators of growth to chart their course:

- Hiring and resource management

- Demand for capacity/ capacity building courses

- Increasing investment in PR, CSR activities as public perception of an organization’ s commitment to ethical governance and environmental responsibility is beginning to play a greater role in determining its structure, function and long-term success

- Increasing adoption, fuelling standardization, as validated measurement and reporting frameworks find their way into compliance protocols

Best Sustainable Finance/ ESG Courses & Certifications (2025)

A day in the life of an ESG Professional

A typical ESG practitioner’s workday involves extensive stakeholder engagement both within and outside the organization, drafting reports, monitoring projects, and managing policies and issues that directly influence the organization’s ESG strategy and its associated rankings/ratings.

An early career role, such as ESG research analyst, primarily involves examining the environmental, social, and regulatory aspects of an investment, and integrating these with relevant financial data. The analyst then presents their findings to investment specialists, senior stakeholders, and occasionally individual clients.

Senior ESG managers are typically supported by a team of analysts and occasionally sector specialists (usually environmental engineering, gender, public policy or law) and often ensure that the organization’s strategy and operations remain aligned with ESG requirements, guiding decisions that optimize the balance between meeting compliance demands and managing associated costs.

Salary Overview

As per Global Sustainable Investment Alliance data from 2022, close to 3 trillion USD in capital has been committed to environmental, social and corporate governance-related investments, and is reflected in the demand for ESG practitioners across sectors.

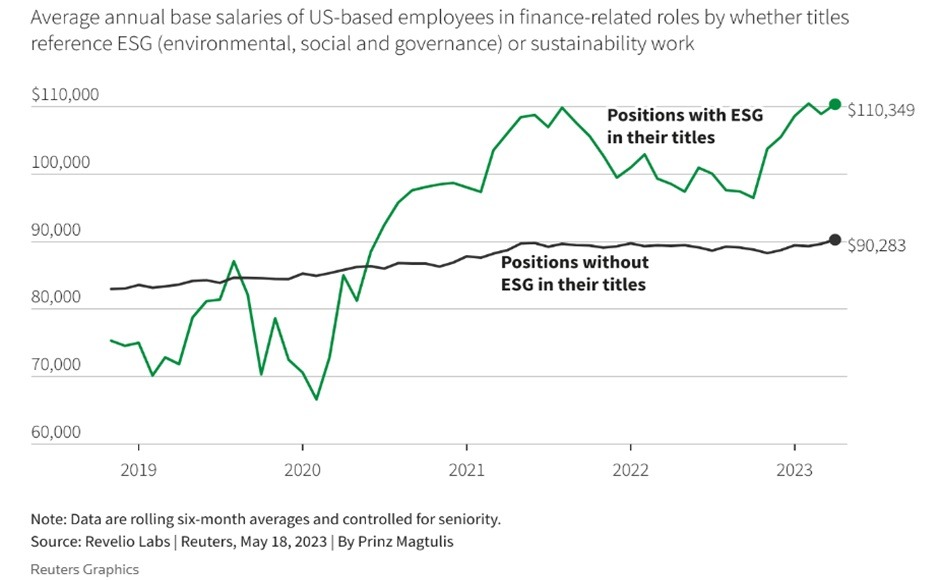

According to a salary analysis shared with Reuters, U.S.-based bankers and asset managers who hold job titles that include “ESG” or “sustainability” tend to earn, on average, about 20% more in base salaries than their counterparts at the same seniority level.

ESG is one of the unique practices that seen to create opportunities for interdisciplinary collaborations, where multi sectoral linkages enable low-cost, lateral transitions into the sector, particularly for practitioners willing and able to invest in ESG skills and certifications that complement their existing experience.

Career opportunities in ESG

Foundational training in ESG and its applications can typically start with a degree in Environmental and Social Governance, Sustainability, Finance, Law, Economics, Public Policy or a related discipline. ESG is a broad and inclusive field with room for practitioners from diverse backgrounds in communications and PR, humanities, engineering, development and business administration and rewards practitioners with the ability to complement their existing experience with strategic certifications and training that amplify their ability to deliver value.

Typical roles in ESG are housed within the functions below:

Environmental Health and Safety Coordination

Managing and implementing safety policies, inspecting the workplace, and coordinating training. Hiring requirements typically specify a Bachelor’s degree in Occupational Health and Safety, Environmental Science, or a related field.

Average Salary- $72,000- $100,000/yr (US)

This is more hands-on and requires handling the day-to-day of running coordination and training sessions.

Environmental Health Safety Management

Creating a safe and sustainable work environment by managing risks and ensuring compliance with health, safety, and environmental regulations. Health scientists, public health and policy practitioners with experience in the interlinkages between environment and health, are typically great fits.

Average salary: $16,000 – $30,000/yr (US)

This typically requires conducting an overview of adherence to practices, and developing newer protocols to match the necessary regulatory requirements and is slightly less hands-on.

Environmental Compliance

Ensuring that the organization adheres to all relevant environmental regulations and collaborating closely with departments such as engineering, legal, and operations to guarantee compliance with regulatory requirements across the organization.

Environmental Compliance Officers typically possess a bachelor’s degree in fields such as environmental science, engineering, or environmental policy. In some cases, a master’s degree may be necessary even for entry-level positions. Additionally, certain certifications may be required depending on the employer’s specific requirements.

Average salary: $61,000 – $100,000 per year (US)

The focus here is less on protocols and implementation but more on reporting and documentation

Environmental Engineering

Design of systems and processes that reduce an organization/industry’s carbon footprint, minimize and manage waste, and the provision of technical support for compliance with local and international compliance standards. Engineers with exposure to compliance and risk management and training in industrial engineering, life sciences, environmental health research are uniquely positioned to leverage their expertise in these roles.

Salary range: $80,000 – $100,000 per year (US)

This is a technical role and focuses on technology, operations and monitoring impact

Sustainability Analysis

Assessing a company’s environmental impact, developing strategies for sustainable business operations, for instance, energy efficiency, waste reduction, and resource management.

Intersectoral in roads and linkages do exist! For instance, an ESG analyst, if employed in a private equity or wealth management firm, ultimately performs due diligence by scrutinizing non-financial aspects of an investment opportunity, such as a project’s environmental impact or public opinion about the company.

Salary range: $68,000 – $100,000 per year (US)

This involves a comprehensive overview of aspects of sustainability, and helping an institution walk the line between operational costs and ESG adoption requirements. Direct data collation, analysis and reporting are key functions

Best Sustainable Finance/ ESG Courses & Certifications (2025)

Social Impact Analysis

Assessing the social impact of an organization’s activities through monitoring, evaluation and learning activities

Salary range: $68,000 – $100,000 per year (US)

Social impact is an important aspect meeting ESG requirements through conducting developmental activities. This specialized role is focused on the impact evaluation of initiatives undertaken by the company.

Sustainability Management

Implementation of environmental and sustainability strategies within an organization, and ensuring alignment with regulatory requirements.

Salary range: $95,000 – $200,000 per year (US)

This position is slightly more management centric than sustainability analysis and social impact analysis. Typically a sustainability manager would oversee aspects of reporting, social impact initiatives and sustainability analysis.

Corporate Social Responsibility

Aligning an organization’s operations with ethical standards, CROs develop and monitor policies related to corporate governance, social responsibility, and environmental stewardship. This typically involves the extension of grants to social impact organizations, or the management of entities through which business organizations can carry out social impact investments

Salary range: $80,000 – $200,000 per year (US)

This role includes overseeing CSR initiatives, engaging stakeholders, and managing social impact investments to ensure positive outcomes for both the institution and society.

Diversity, Equity and Inclusion

Creation of inclusive workplaces/policies. While traditionally incubated within human resources, the growing emphasis on DEI has led to the establishment of independent DEI divisions in many organizations. This shift is driven by both regulatory requirements and the need to meet eligibility criteria for funding and incentives.

Salary range (specialist): $79,000 – $100,000 per year (US)

Based on the seniority of the role, DEI would involve developing strategies that foster a culture of diversity and addressing systemic inequalities. Early career positions could involve setting and meeting measurable goals for diversity hiring, creating policies and programs to support equity in the workplace.

Communications and Public Relations

Creating a perception of understanding and incorporating stakeholder values within organizational strategies and crafting compelling narratives that foster trust. This is where PR/Communications professionals within the ESG sector with exposure to regulatory requirements within the concerned industry could have a competitive edge in these roles.

Salary range (specialist): $68,000 – $100,000 per year (US)

Based on varying levels of seniority this role involves creating or going about the day to day execution of strategies to communicate the organization’s ESG achievements and values to stakeholders, while managing media relations and public perception.

Leveraging gaps within the ESG sector to build a high impact portfolio

Skill gaps within mature industries

There is a gap in expertise in sustainability reporting measures primarily because ESG reporting still evolving with few hiring managers and project leads with expertise in the area. There is also a lack of consensus on what data to collect and report on, and existing reporting guidelines changing in response to the dynamic socio-political landscape of an increasingly interconnected world.

Training in data science, database management, data collection and reporting is ubiquitous. If complemented with training/certification and formal/informal exposure to compliance and risk management, this can enable a practitioner to lead multiple facets of ESG across several industries. Programs like the Global Reporting Initiative (GRI), SASB (Sustainability Accounting Standards Board), or certifications from institutions like CFA Institute’s ESG Investing Certification can complement foundational training in STEM, Law and even humanities to bridge these gaps. Further exposure can be gained through volunteering experience and internships.

Best Sustainable Finance/ ESG Courses & Certifications (2025)

Reporting Standards differ across industries and geographies, complicating inter-sectoral/ institutional partnerships leading to data loss and redundancies

Although ESG reporting requirements appear to be growing consistently across sectors, geographical variations in regulatory requirements complicate the usability and generalisability of data and insights between collaborating organizations/sectors.

Practitioners with an understanding of database design and management, specializing in ESG performance measurement metrics across sectors could help identify and address incompatibilities in their digital data collection and management architecture, aiding partnering institutions in pooling their resources to meet ESG compliance requirements, and to leverage adherence linked incentives.

| Graduating to leadership in ESG |

|

Crafting a transition strategy

ESG professionals have the potential to evolve into influential strategists and thought leaders. However, timing plays a crucial role in this progression, particularly in addressing any gaps in one’s skill set. As the ESG sector matures, the opportunities for leadership will likely diminish, making it essential for practitioners to assess whether their current exposure will translate into a rewarding next phase in their careers. This assessment is time sensitive, and requires practitioners to consistently respond to the dynamics of the sector.

This assessment must be used to guide the selection of the most suitable ESG practice, which in turn could ensure seamless transition into the next stage of a practitioner’ professional journey. For instance, experience in ESG consulting could naturally lead to roles in general management, policy-making, or corporate strategy. Additionally, the relatively nascent nature of ESG opens doors to careers in research and innovation without the classical lag experienced by traditional academics.