Equity research is one of the most basic and fundamental roles in the financial market. This role has been around for decades and has launched many successful careers catapulting bankers to the very top of investment banks, hedge funds and other financial services firms. This is the ideal starting point to launch a career in finance as you will learn the very basics of what value actually means in the context of the markets.

Given the absolutely fundamental nature of this role, it is imperative that you have a very good and thorough understanding of what this role actually entails. Whether your motivation is to break into an equity research role, or you are just using this as a stepping stone to other career choices, this is the ideal starting point.

All the courses in this list are from the absolute best course providers in the world. I have kept this list short as I do not want to pad it with unnecessary courses that do not really make the cut. I have taken all of these courses personally, and I can assure you that you cannot go wrong with any of them. The choice should be made on basis out what you prefer and how much time you have on your hands.

1. Applied Value Investing Certificate Program from Wharton & Wall Street Prep

(Note: Use the above link and code BANKERSBYDAY for $300 off tuition on this course)

The Applied Value Investing Certificate Program focuses on analysis of public equity investments using the theory, practices and strategies employed by some of the worlds leading hedge funds and institutional investors. This certificate gives you the unique opportunity to learn not just from Wharton faculty but also experienced investors and leaders form some of the worlds top investment firms.

The eight week program has been divided into eight modules, each covering a specific topic related to buy-side investing. The first two modules focus on the basics like market efficiency theory, corporate finance concepts, capital markets & IPOs, active mismanagement, valuation approaches, competitive strategies and so on. Then we move on to more advanced topics like modeling including DCF, Comps, and an in-depth exploration of information gathering, analysis and forecasting. The next couple of modules are all about delving an investment thesis which means idea generation, assessing business fundamentals, valuations, the rationale behind investment choices and short selling strategies. Lastly, we move on to advanced topics like dealing with market downturns, avoiding thesis creep, and just being a great analyst overall.

Click here and use code BANKERSBYDAY for $300 off tuition on this course!

Summary

| Duration | 8 weeks, at around 8 hours weekly |

| Format | Fully online |

| Level | Professional |

2. Research Analyst Micro-Degree from Financial Edge

(Note: Use code BBD25 for 25% off at Financial Edge)

This is a micro degree which means it is more detailed and thorough than most courses and can be thought of as a compact and highly specialised degree in equity research.

This is a micro degree which means it is more detailed and thorough than most courses and can be thought of as a compact and highly specialised degree in equity research.

The micro degree is composed of several modules each of which covers a specific area like accounting, modelling, valuation, markets and investing. Additionally, there is also an interview with an equity research analyst so that you can get an idea of what it’s really like to work in this role on a day-to-day basis.

There are several dozen hours of videos that cover each of the topics along with hundreds of practical exercises in Excel format. This approach really helps you to quickly go through the material first and then test what you have learned immediately afterwards with the Excel exercises.

Videos are of high quality and easy to understand. I found them to be thorough, comprehensive and insightful. The expertise of the instructors does shine through and the quality is apparent. I do enjoy doing all of the exercises and they range in difficulty from basic to intermediate and they are appropriate for equity research analysts on both the buy and sell sides.

This is the same course that is delivered to research analysts at some of the biggest investment banks and Wall Street firms. You will be going through the same material and learning the same things that hires at these top Wall Street firms did.

Financial Edge is a top tier training provider to the financial services industry and their exceptional quality shines through in this course as well. This is one of the better structured and delivered equity research courses out there.

Click here and use code BBD25 for a 25% discount on all Financial Edge courses!

3. Equities Markets Certification from WSP

If you are looking for a quick but thorough introduction to equity markets, then this is the course for you. In about 10 hours, you will be able to confidently talk about equity valuation, ETFs, hedge fund strategies and even ESG investing. This is a broad certification which touches upon almost all the topics that you need to know about in an equity analyst role.

You will cover topics such as cash equity, exchange trading, order types, equity valuation using PE ratios, EPS and other ratios. You will learn equity indices like the S&P 500 and how asset managers invest funds for both institutional and retail investors. Equity futures and derivatives are also covered along with Hedge Fund strategies including macro, relative value and credit Hedge funds etc.

You get a nice certificate that you can embed to your LinkedIn profile or anywhere else

Securities lending and prime brokerage is the next topic to be covered and the various models that are used in this business. Lastly, we move on to a very important and up-and-coming field which is ESG investing, green bonds and social bonds. This topic gets through coverage and should set you up for things to come. Also, you will be using and learning about Bloomberg and how to use it properly for equity analysis.

Wall Street Prep is a premier course provider for top financial services firms across the world. As someone who has taken most of their courses, I can tell you that the main strength is these give you practical insights into how things work at actual financial services firms. The jargon, the shortcuts, the lingo. This is the main strength of this course.

Click here and use code BANKERS for a 15% discount on this course!

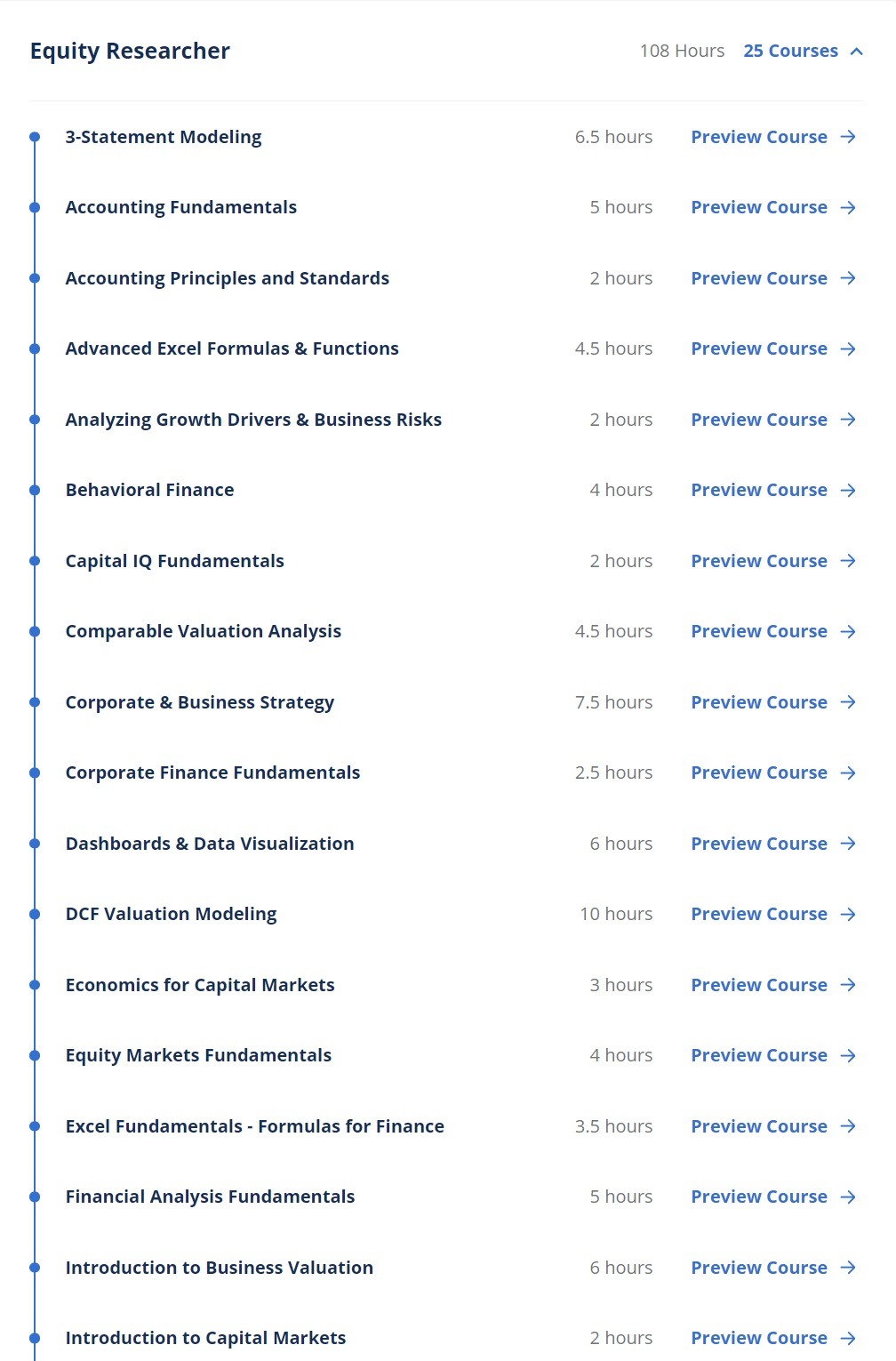

4. Equity Researcher Learning Path from CFI

The Equity research learning path from CFI is a whopping 25 courses spread across roughly 108 hours of material. This is a very thorough course that will touch upon almost everything that you need to know to be in the equity research business. The good thing about this is that you don’t have to take all of the courses. You can take the courses that you need and for topics that you are already familiar with, you can skip them or take them later.

For example, courses related to basic accounting fundamentals and principles might be something that you are already familiar with. However, if you want to revise or relearn, you are more than welcome to take these courses and just brush up what you already know. The meat of the course is of course the valuation, modelling and analysis courses. Things like DCF valuation, financial analysis, business valuation, capital markets, scenario and sensitivity analysis etc. It’s all in there and its all pretty good.

There are lot of practical exercises that utilise Excel and feel like the real deal. Practical exercises that will make you feel like you’re working on real world scenarios using the same methodology, constraints and assumptions that you would in the real world. And to reach the same conclusions and decisions that you would in the real world.

The courses are well structured with plenty of well delivered videos that never overwhelm you while still ensuring that all the technical information is delivered accurately.

Click here and use code BBD10 for 10% off!