The most critical sections of the investment banking interview are financial modeling questions. Preparing for these questions can take up to 8-10 weeks, as they require a deep understanding of financial modeling concepts and practices. While learning how to model is essential, this blog is intended to provide a comprehensive list of interview questions to help you prepare effectively. If you have prior experience in financial modeling, you can skip directly to the final part of the blog with a list of financial modeling interview questions.

What is Financial Modeling?

Financial modeling is a type of quantitative analysis commonly used in corporate finance, investment banking, and portfolio management to forecast a company’s financial performance. The model is typically built in Excel or using specialized financial modeling software. Building a model involves creating multiple spreadsheets that contain historical data and future projections.

Applications of Financial Modeling:

Financial modeling is a fundamental tool in business and finance for several key reasons. These are the primary purposes and benefits of creating and using financial models:

- Value a business for an M&A transaction: Financial models such as those using Discounted Cash Flow (DCF) analysis are integral to assessing business value for a purchase or sale.

- Calculate the maximum purchase price in an LBO transaction: Financial models should incorporate a target company’s cash flows, costs, debt structure, and repayment plans. These models help investors understand break-even points and the effect of leverage on returns, which are crucial for informed bidding decisions.

- Calculate the intrinsic share price as part of an equity research report: Financial models can be used to estimate the intrinsic share price by analyzing a company’s financial statements, growth prospects, and market conditions. These models help equity analysts determine whether a stock is undervalued or overvalued based on an estimate of intrinsic worth, guiding investment decisions.

- Making capital budgeting & forecasting decisions: Financial models are used to evaluate potential investments and forecast future financial performance. By analyzing projected cash flows, costs, and returns, these models help companies make informed capital budgeting decisions, ensuring optimal allocation of resources to maximize profitability.

- Capital restructuring decisions: Financial models assist in capital restructuring decisions by evaluating the impact of changes in the capital structure on a company’s financial health. These models analyze various scenarios, such as issuing new equity, refinancing debt, or altering dividend policies, to determine the most beneficial approach for enhancing shareholder value.

- Other business restructuring decisions: Financial models are also crucial for other business restructuring decisions, such as selling a segment of a company. By assessing the segment’s financial performance, prospects, and potential market value, these models help companies make strategic decisions that align with their overall business goals and improve operational efficiency.

Quick Guide to Forecasting the Income Statement and Balance Sheet

Forecasting – Income Statement

Forecasting sales is the most critical element in creating a pro forma income statement for most companies. Sales are also the primary driver for estimating costs, as most costs are variable and dependent on sales. Although the method for forecasting sales varies across different industries, a general rule of thumb is to predict both volume and price. These can be forecasted as follows:

- Volume: Influenced by the company’s historical growth, overall industry growth, and market share growth. It is also affected by new product launches and access to new markets

- Price: Affected by general market inflation, the company’s ability to pass higher costs to consumers, and industry competitiveness to support the targeted sales volume

Note: It is advisable to incorporate these factors across different business segments before modeling overall sales.

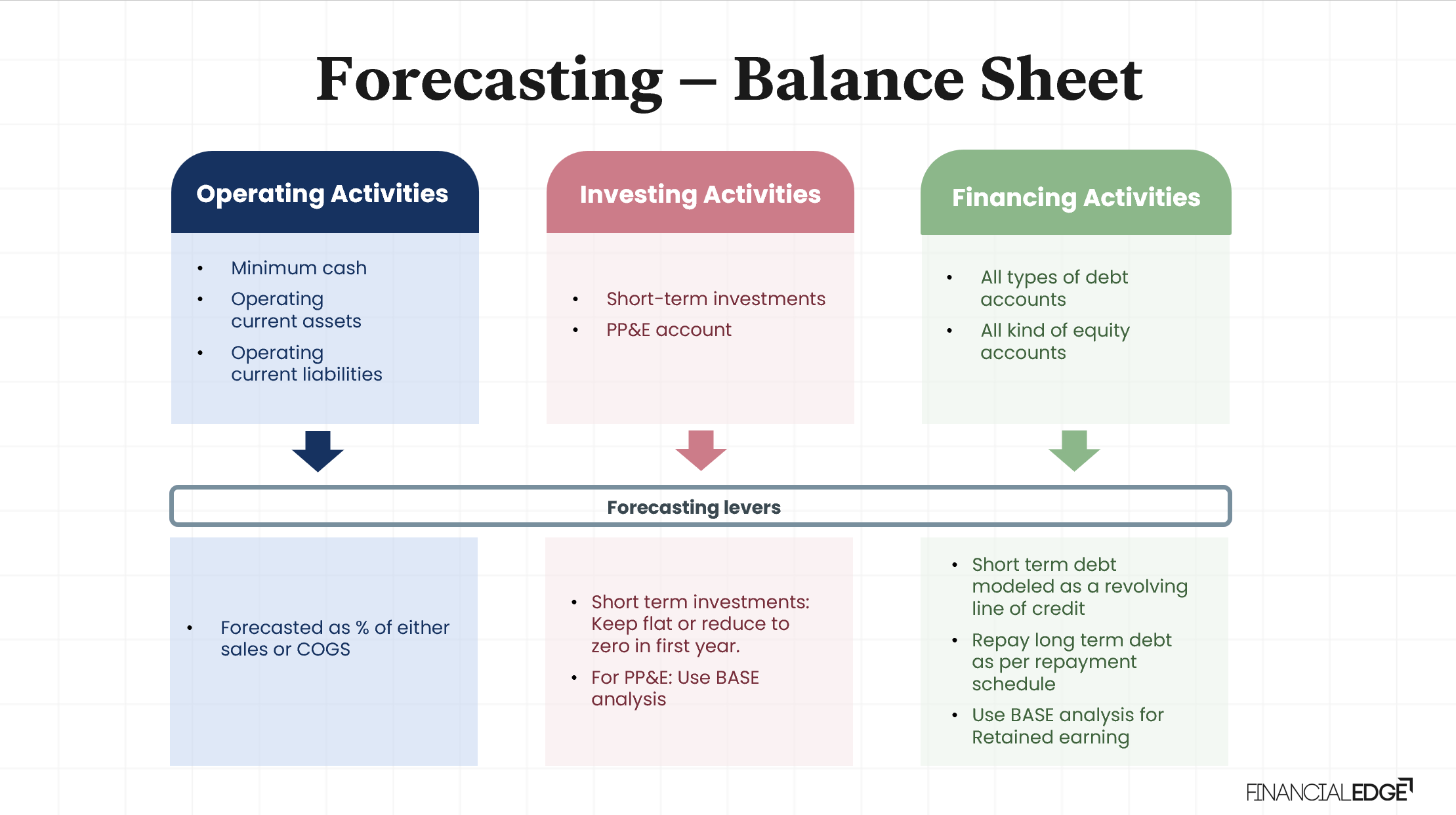

Forecasting – Balance Sheet

When creating the pro forma balance sheet, identify accounts driven by the following activities:

- Operational activities: Accounts driven by day-to-day business activity

- Investing activities: Accounts driven by management’s investing decisions

- Financing activities: Accounts driven by management’s financing decisions

35 Financial Modeling Interview Questions

Prepare yourself to answer these financial modeling interview questions by enrolling on the investment banking course. The course reflects the same training new analysts receive at the leading investment banks on financial modeling, as well as key accounting, valuation, M&A and LBO analysis.

Income Statement

- How would you estimate revenue for the next few years?

- Would you assess different risks associated with different scenarios? How would you incorporate those in your model?

- For how many years would you project revenue? Is a five-year timeline sufficient?

- How would you project COGS?

- How do you calculate gross margin? Would you assume it to be constant, increasing, or decreasing, and why?

- What is SG&A? What kind of expenditures are included in this category?

- How would you estimate depreciation? How is it different from other expenses?

- What is the role of capex in projecting depreciation?

- What is a non-recurring expense? How do you model it?

Balance Sheet

- What are cash and cash equivalents (CCE)? What is the difference between CCE and marketable securities?

- How would you project inventory? Is inventory relevant for every industry?

- What is operating working capital (OWC)? Why would some companies within the same industry have negative OWC while others have positive OWC? Why is negative OWC preferred?

- How would you project Plant Property & Equipment (PPE)? What are the key levers to consider? How does PPE impact cost and revenue estimates?

- How would you calculate the maximum debt level?

- Considering the pros and cons of debt versus equity financing, what factors would you weigh to determine the best approach for raising capital?

- How do you prepare a debt payment schedule? How does it impact the firm’s credit rating?

- What is excess cash? How do you calculate it?

- What is a revolver? How do you calculate the revolver amount?

Cash Flow Statement

- What is the objective of creating a Cash Flow Statement (CFS)?

- What are the three key line items of the CFS?

- What are the two most common methods to calculate cash generated from operating activities (CFO)?

- Why does an increase in current assets have a negative impact on CFO while an increase in current liabilities has a positive impact?

- Is it possible for a company to generate consistent profits year after year but struggle to pay employee salaries and meet other operating expenses? How would you identify the issue by looking at the CFS?

Financial Ratios

- What are the key liquidity ratios?

- What are the key asset management ratio?

- What is the key debt management ratio?

- What is the key profitability ratio?

Excel Formulas

- Given a financial model with multiple variables, explain how you would use Goal Seek to find the input value needed to achieve a desired outcome.

- How would you use VLOOKUP or INDEX/MATCH to find specific data points based on certain criteria? Explain the advantages and disadvantages of each function.

- How would you handle missing data points or inconsistencies in a dataset before using it for financial modelling?

- How would you ensure your financial model is free of errors?

Beyond knowing these formulas, be prepared to discuss how you approach building efficient and well-structured financial models in Excel.

List of Key Terminologies Applicable for Financial Modeling:

- What is NPV? What is XNPV

- What is IRR? What is XIRR?

- What is FCF to firm (FCFF)?

- What is FCF to equity (FCFE)?

Conclusion

As you prepare for your investment banking analyst interview, focus on building a strong foundation in financial modeling. Practice extensively with sample models, familiarize yourself with industry-specific nuances, and refine your ability to use Excel for financial analysis. This will not only help you answer interview questions confidently but also enable you to contribute effectively to your future role. Financial modeling is a critical skill in investment banking, and with dedication and practice, you can master it and achieve success in your career.